EVs on Life Support (Part 1): Norway’s Stellar EV Adoption Story

EV sales are on fire in Norway and in China but there’s more to the story than it seems. The EV market is propped up by incentives that when reduced or eliminated cause chaos. Just ask other Europeans

September has been a fantastic month for EV sales in Norway and China. The Norwegian Road Federation released its vehicle registration figures mid-month highlighting that electric vehicles (EVs) now outnumber gasoline powered vehicles in Norway. At the same time, sales data revealed that EVs made up 94% of vehicle sales in August, a meteoric rise as one publication puts it.

Electric vehicles continued their meteoric rise in Norway, capturing a staggering 94.3% of the new car market in August.

This unprecedented achievement surpasses previous records and underscores Norway’s position as a global leader in EV adoption.

At the same time, data released by the China Association of Automobile Manufacturers (CAAM) revealed that 1.1 million new energy vehicles (NEV) have been sold in China just in the month of August.

While these news items were picked-up with great enthusiasm, something didn’t really add up. I remembered reading about China DOUBLING its cash subsidy for replacing conventional vehicles with EVs. Why would the country double the subsidy if sales were so great? Turns out there was more to that story and that of Norwegian EVs than met the eye.

This first part starts by exploring how Norway became the EV adoption success story.

Norwegian EV Adoption Success

Norway is one of the few examples where EV adoption has skyrocketed. In 2014, 1% of vehicle sales were EVs, a far cry from August figures (94.3%) for instance. How did Norway achieve this impressive feat? Forbes provides an excellent summary:

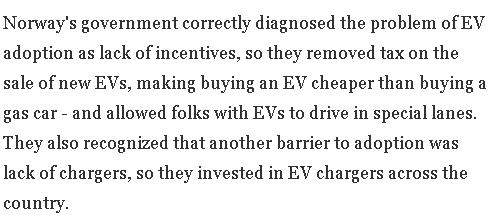

Norway's government correctly diagnosed the problem of EV adoption as lack of incentives, so they removed tax on the sale of new EVs, making buying an EV cheaper than buying a gas car - and allowed folks with EVs to drive in special lanes. They also recognized that another barrier to adoption was lack of chargers, so they invested in EV chargers across the country.

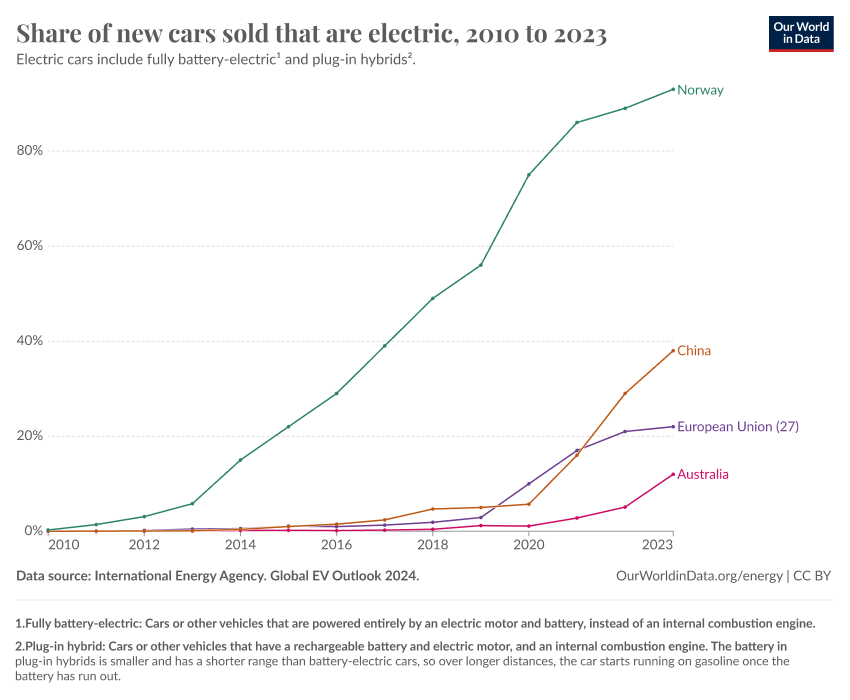

EVs weren’t selling at the required pace because they were too expensive. So, the government distorted the market. That’s not a new strategy. Incentives and tax breaks have been applied across the board in the E.U., the U.S., China, Australia. However, while these had some impacts, no incentive scheme realised the same impact as in Norway (see graph below). Norway took incentives a step further and made EVs CHEAPER than conventional vehicles, not by a bit but by a lot!

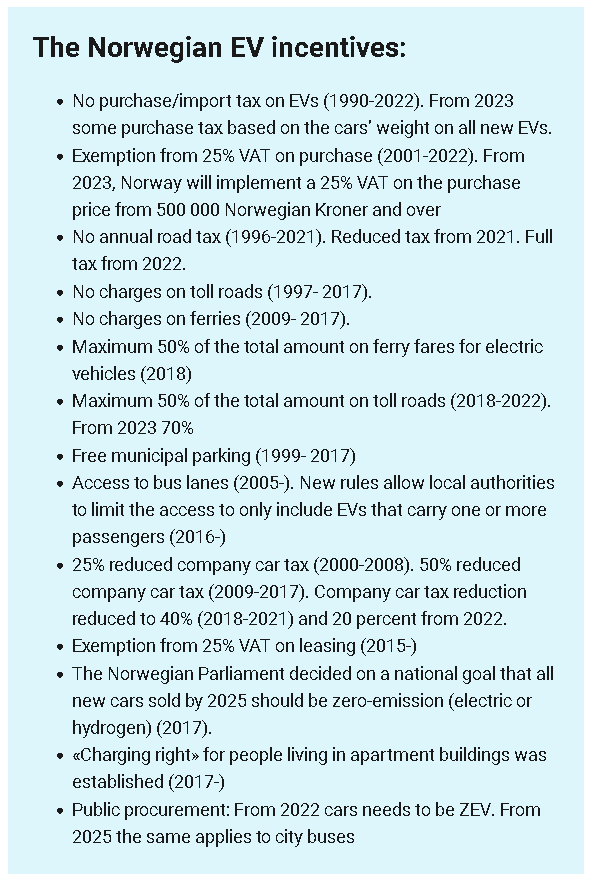

The Norwegian government incentives were extremely aggressive. EVs were exempted from the auto-purchase tax, that is on average of US$ 27,000 (EUR 24,000) and exempted EVs from paying for VAT/GST that amounts to an additional 25% (This exemption was tightened as of 1st of January 2024 to only apply for the first 500,000 Norwegian Kroner or EUR 42,500 of the vehicle price). A whole heap of other incentives were introduced, many of which are still active, even if in a watered down version.

The Norwegian EV incentives:

No purchase/import tax on EVs (1990-2022). From 2023 some purchase tax based on the cars’ weight on all new EVs.

Exemption from 25% VAT on purchase (2001-2022). From 2023, Norway will implement a 25% VAT on the purchase price from 500 000 Norwegian Kroner and over

No annual road tax (1996-2021). Reduced tax from 2021. Full tax from 2022.

No charges on toll roads (1997- 2017).

No charges on ferries (2009- 2017).

Maximum 50% of the total amount on ferry fares for electric vehicles (2018)

Maximum 50% of the total amount on toll roads (2018-2022). From 2023 70%

Free municipal parking (1999- 2017)

Access to bus lanes (2005-). New rules allow local authorities to limit the access to only include EVs that carry one or more passengers (2016-)

25% reduced company car tax (2000-2008). 50% reduced company car tax (2009-2017). Company car tax reduction reduced to 40% (2018-2021) and 20 percent from 2022.

Exemption from 25% VAT on leasing (2015-)

The Norwegian Parliament decided on a national goal that all new cars sold by 2025 should be zero-emission (electric or hydrogen) (2017).

«Charging right» for people living in apartment buildings was established (2017-)

Public procurement: From 2022 cars needs to be ZEV. From 2025 the same applies to city buses

State-Sponsored Auto Market Distortion

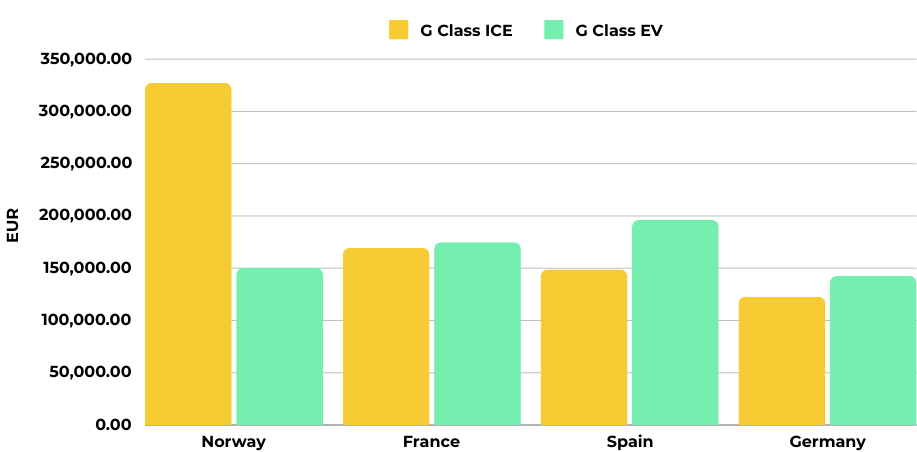

To understand just how much Norway distorted its auto market it’s worthwhile comparing EVs with their ICEV alternatives. I looked specifically for the same vehicle that has an electric and a petrol variant still available. Unfortunately, there’s not that many ICEVs left for sale, except in the luxury end of town. This search led to the Mercedes G-class, that is still available in both electric and ICE variant.

The ICE G-class’ list price is NOK 3,840,625 or EUR 327,263.84. The EV G-class list price is NOK 1,764,625 or EUR 150,365.62.

That means the ICE alternative is 2.2 times the price of an EV.

The ICE G-class’ list price is NOK 3,840,625 or EUR 327,263.84. The EV G-class list price is NOK 1,764,625 or EUR 150,365.62. That means the ICE alternative is 2.2 times the price of an EV. The market distortion is actually worse than it seems. The G class ICE sells in Germany for EUR 122,808 (EUR 200,000 less than in Norway) while the EV version sells for EUR 142,621.5 (The ICE version is 14% less than the price of the EV). The G class ICE sells in Spain for EUR 148,675 while the EV version sells for EUR 196,221.01 (The ICE version is 25% less than the price of the EV) while in France, the G class ICE sells for EUR 169,351 while the EV version sells for EUR 174,951 (The ICE version is 3% less than the price of the EV). The EV prices in Germany, Spain and France are no doubt already subject to subsidies and incentives although to a lesser extent. Not only did Norway reduce the production cost gap between ICEs and EVs, they insured that the gap was reversed with EVs being less than half the price of an ICE alternative.

To top it all off, the Norwegian Parliament decided on a national goal that “all new cars sold by 2025 should be zero-emission (electric or hydrogen)”, effectively eliminating ICEV from the market. Theoretically, this provides a choice for consumers, either electric or hydrogen. In reality, there is no choice in terms of fuel type, mostly because there are few (if any?) hydrogen-powered vehicles on sale. Toyota for instance doesn’t sell the Mirai, one of the few hydrogen powered vehicles, in Norway. Hence, the Norwegian parliament has essentially decided that the future is electric and has ensured that this will be made reality.

When what looks like predatory pricing is used to advance government emissions reduction objectives, it’s not only not illegal, but in fact, a success story of a sensible environmental policy.

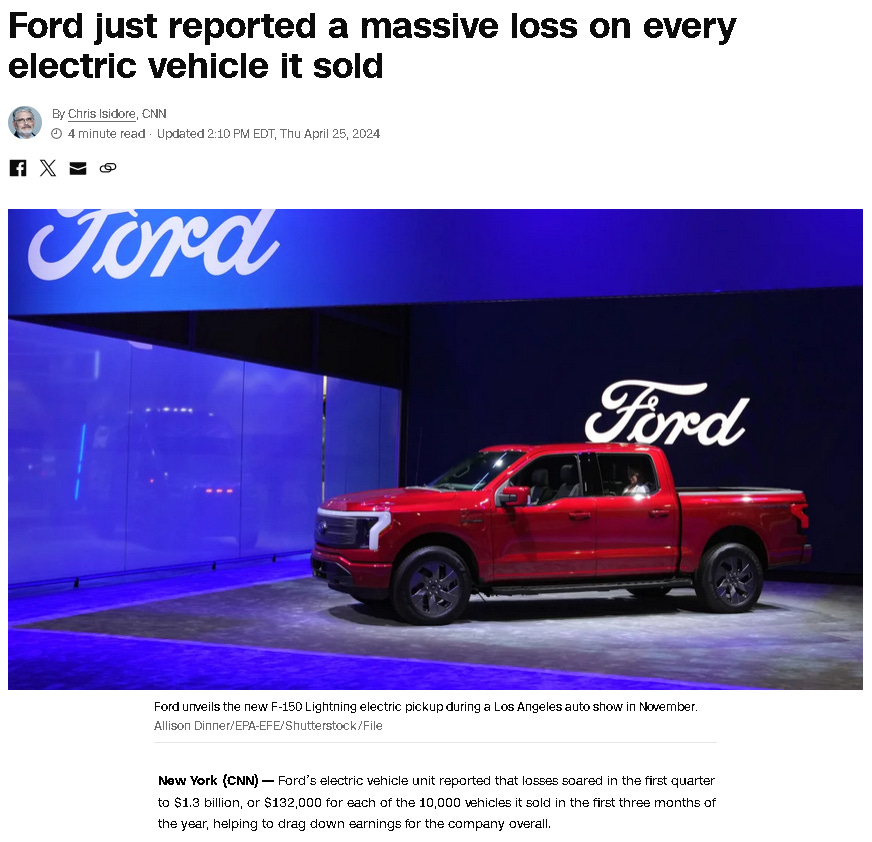

If the Norwegian approach sounds familiar but you just can’t put your finger on it, it’s because it is rather similar to a commercial practice called price dumping or predatory pricing. Lowering prices below production costs, effectively loosing money on every sale to weaken or eliminate competition from a market with the purpose of gaining and consolidating a monopolistic position in the market, a position that will typically allow companies to reclaim their previous losses. This is currently happening in private companies anyway -see for instance Ford loosing US$ 100,000 to US$ 132,000 on every EV sold, depending on the information source. However, when what looks like predatory pricing is used to advance government emissions reduction objectives, it’s not only not illegal, but in fact, a success story of a sensible environmental policy.

The Cost of EV Adoption Success

Beyond the financial impost of EV subsidies, the true cost of Norway’s EV adoption success is that the country’s auto market is now on semi-permanent life support […] The problem with subsidies, especially those that distort the market to such a massive extent, is that removing them, even partially, may essentially kill the market for BEVs. The consequences of this may be either the reintroduction of ICEs in the auto market or the substantial reduction of personal mobility.

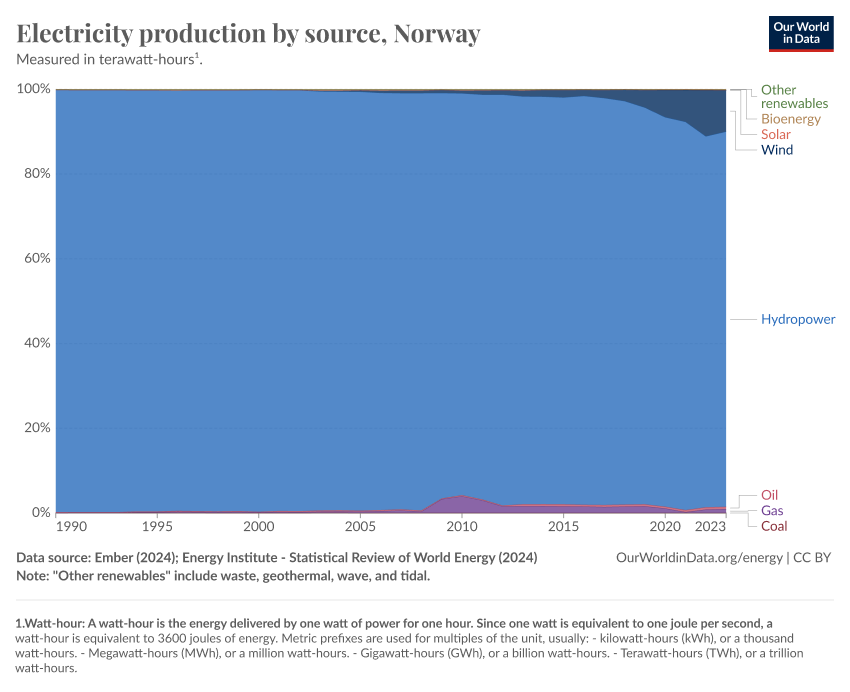

To be fair, if tailpipe emissions reduction is the absolute goal, Norway’s approach may make sense to some extent. The country generated over 88% of its electricity from hydro energy in 2023. The electricity emissions factor was 0.00449 kg CO2-e/kwh of electricity generated. Hence, each ICE transitioned to a BEV essentially reduces tailpipe carbon emissions by about 99.5%. However, this comes at quite a cost.

Beyond the financial impost of EV subsidies, the true cost of Norway’s EV adoption success is that the country’s auto market is now on semi-permanent life support. In 2022 the country estimates that EV incentives cost more than USD 4 billion (EUR 3.6 billion) or approximately 2% of its tax revenue. It is expected that this figure will gradually reduce as subsidies are curtailed. In fact, the country has been trying to reduce incentives for BEVs since 2017. However, the incentives currently offered for BEVs are still an order of magnitude higher than those offered in almost any other European country. The problem with subsidies, especially those that distort the market to such a massive extent, is that removing them, even partially, may essentially kill the market for BEVs. The consequences of this may be either the reintroduction of ICEs in the auto market or the substantial reduction of personal mobility.

Stay Tuned for Part 2: China NEV Powerhouse

Norway’s EV adoption story is different than China’s, a country that doesn’t enjoy the same electricity fuel mix (spoiler alert, it’s mostly coal) nor has made real commitments towards emissions reduction goals but that has however spent more than USD 230 billion to support EV adoption. However, a common feature of both countries’ EV markets is that they’re both on a lifeline, albeit perhaps for different reasons.

Stay tuned for the following post exploring China’s EV market.

AI Not There Just Yet

I’ve been having some fun with AI-generated images for my posts. Although I’m impressed with its capabilities, it’s interesting to notice the things that AI doesn’t get quite right. Those small things that tip one off about who created a particular scene. The image below was the first response to the prompt. The colors were more vibrant and the whole scene looked as i wanted it, with the exception of a small detail: the electric vehicle was plugged in where the headlights were supposed to be. I can’t get myself to post an image of a vehicle that wouldn’t be road-legal on our front page, but this does make the hall of fame.